A look at the day ahead in European and global markets from Tom Westbrook

Summer may be finished, but the hot sun is helping energy prices off eye-watering highs. Benchmark German year-ahead power prices have collapsed 35% this week, helped by solar supply and ebbing gas costs.

As Rabobank’s Michael Every put it, that brings us from “‘nobody can pay’ to ‘very few can afford to pay’ territory.”

What a relief! As anyone schlepping back to the desk this week has found, in addition to airport chaos, markets are down, euro zone inflation is at record highs and energy costs have British pubs in an existential crisis.

Another month of contractionary PMIs loom today, and the latest out of Asia has not been great. China’s factory activity fell for the first time in three months and there were weak readings in Japan, South Korea and Taiwan.

The yen hit a 24-year low. Asia’s stock markets <.MIWD00000PUS> fell for a fifth straight session and U.S. and Europe futures are firmly in the red. [MKTS/GLOB]

The chill over geopolitics, meanwhile, is deepening as winter approaches. Russia may or may not resume sending gas down the Nord Stream pipe on Saturday. The U.S. has told Nvidia to stop exporting certain chips to China.

The U.N. human rights chief has said detention of Uyghurs in Xinjiang may constitute crimes against humanity, drawing a vigorous denial from Beijing.

Springtime seems a long way away.

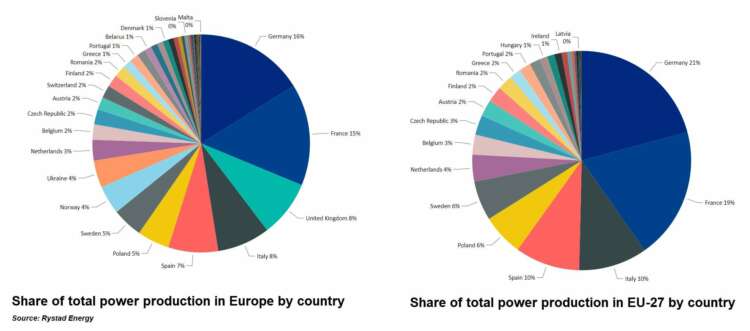

Graphic: Historical power production totals for Europe and EU-27 – https://fingfx.thomsonreuters.com/gfx/mkt/myvmnedqkpr/pie%20charts%20of%20total%20production.png

Key developments that could influence markets on Thursday:

Economics: European manufacturing PMI and unemployment. U.S. ISM survey

Speakers: ECB’s Mario Centeno, Atlanta Fed President Raphael Bostic

(Reporting by Tom Westbrook; Editing by Ana Nicolaci da Costa)